Pension Review

Financial resilience and security are fundamental in terms of financial wellbeing and overall employee wellbeing.

- Does your Pension integrate with your other financial wellbeing initiatives?

- How engaged are your employees with what is provided?

- Do you understand the real cost of your scheme charges?

Key Features

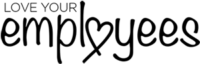

Simple and Intuitive - User Friendly Interface

We understand that pensions can be intimidating for people who are not familiar with them. We’ve built this tool to be as user friendly and as intuitive as possible, giving you simple, clear outputs in plain English. We don’t go into technical specifics; we want to create something practical you can use for the benefit of your business and your employees.

Simply answer our questions and our smart assessment does the rest.

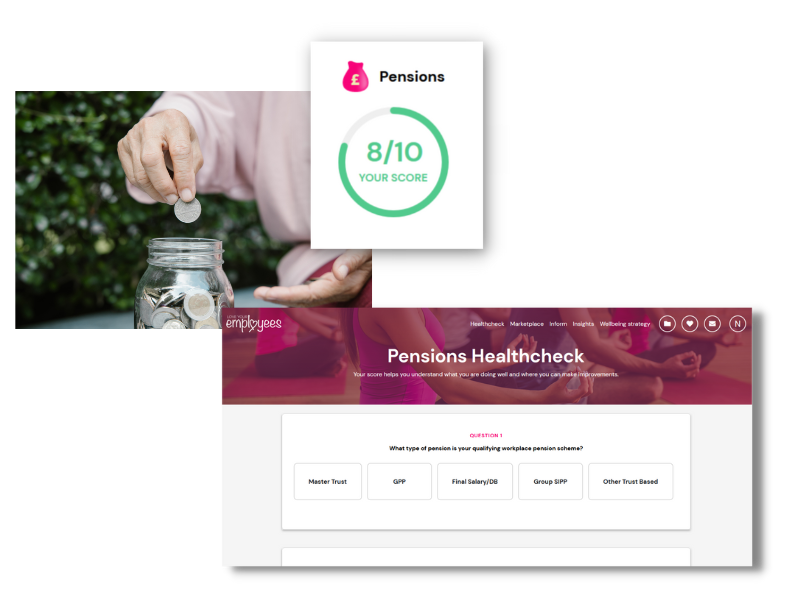

Built by Industry Specialists - Look at the Full Picture

Using the knowledge and experience of our team and our trusted specialist partners, some of the biggest in the pensions industry, we look at every aspect of your current workplace scheme. Your score is broken down in to 5 key areas, taking into consideration the key elements of good pension provision.

We look at Governance, Costs and Charges (for the business and the employees), Investments, Administration and Engagement.

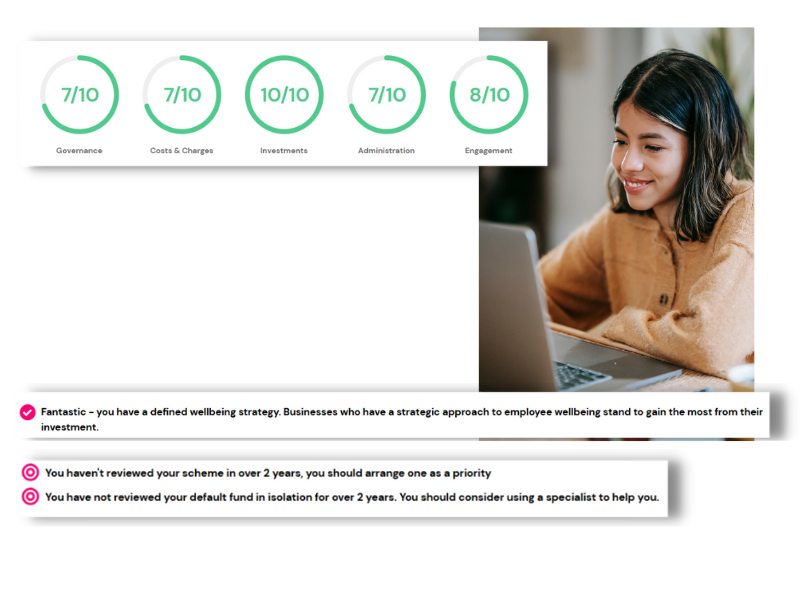

Use Our Tech to Save Time - Be More Informed and Take Control

Use Our Tech to Save Time – Be More Informed and Take Control

Use as part of your due diligence process. Our review is a great starting point in understanding and fulfilling your legal pension obligations. It’s simple and straight forward. Our software gives you the information you need to have informed conversations with advisers, your current scheme provider or even when speaking to potential new providers.

Put simply, to help employers provide the best possible benefits for their employees.

Quality can be determined by several factors such the levels of cover and customer claims experience through to added value services that are included over and above the insurance itself. Many providers are now wrapping multiple add on services into their products giving employers and their employees so much more for their money.

Modern policies and products not only provide security and peace of mind for when things go wrong, they proactively encourage and drive positive lifestyle change so to help prevent things going wrong in the first place. The knock-on effects are proven to impact employee performance and in turn provide positive outcomes for employers.

Get Your Score

Big changes are afoot in the pension industry and businesses are going to be left behind. That’s bad news for your organisation and bad news for your employees. Don’t get left behind.

- Get a neutral, bias-free review of your scheme

- Find out if your scheme costs are what they should be

- Are you paying unnecessary, hidden fees?

- Identify ways you can boost employee engagement

- Does your scheme include quality added value services

- Find out how to reduce NI costs for your business