Your Benefits Review

Core benefits account for a big percentage of a typical business’s employee benefit budget. It makes sense therefore to be proactive in making sure your employees are getting the best quality of product possible for your investment.

You can work through our review in your own time, without pressure, to gain insight into your core benefits to identify where improvements (if any!) can be made.

Some questions to ask yourself:

- Do your core benefits encourage and drive wellbeing?

- Do your employees have an app to easily access and engage with their benefits?

- Have you fallen into the auto-renew trap?

- Does each benefit serve a purpose or can money be better used elsewhere?

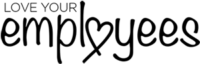

Simple and Intuitive - User Friendly Interface

Many businesses are not as proactive as they could be when it comes to reviewing their core benefits due to the perceived hassle and time involved. We wanted to build something useful and straight forward to help make life easier. We don’t go into technical specifics; we want to create something practical you can use for the benefit of your business and your employees.

Simply answer our questions and our smart assessment does the rest.

Built by Industry Specialists - Look at the Full Picture

Our benefit review is built in conjunction with our specialist benefit partners who have many years’ experience in the employee benefit industry. The review focuses on the 4 core benefit products, critical illness, group life cover, income protection and private medical insurance. We also take a look at voluntary benefits and benefit platforms.

We look at Governance, Costs and Value (for the business and the employees), Technology, Range and Quality and Engagement.

Use Our Tech to Save Time - Be More Informed and Take Control

Use as part of your due diligence process. Our review is a great starting point in understanding and getting the biggest impact of your benefit investment. It’s simple and straight forward. Our software gives you the information you need to have informed conversations with advisers, your current product providers or even when speaking to potential new vendors.

Put simply, to help employers provide the best possible benefits for their employees.

Quality can be determined by several factors such the levels of cover and customer claims experience through to added value services that are included over and above the insurance itself. Many providers are now wrapping multiple add on services into their products giving employers and their employees so much more for their money.

Modern policies and products not only provide security and peace of mind for when things go wrong, they proactively encourage and drive positive lifestyle change so to help prevent things going wrong in the first place. The knock-on effects are proven to impact employee performance and in turn provide positive outcomes for employers.

Get Started

- Access to the Love Your Employees platform

- Direct access to the Love Your Employees team for help, recommendations, and support

- Insight and news around the latest wellbeing trends direct from industry specialists

- Access to research reports and whitepapers, both from us and our partner network

- Personalised updates and recommendations

- Access to preferential rates and exclusive deals